- Finance

- Vertical SaaS

- Accountech

- HR Tech

- Time & Attendance

- Point of Sale

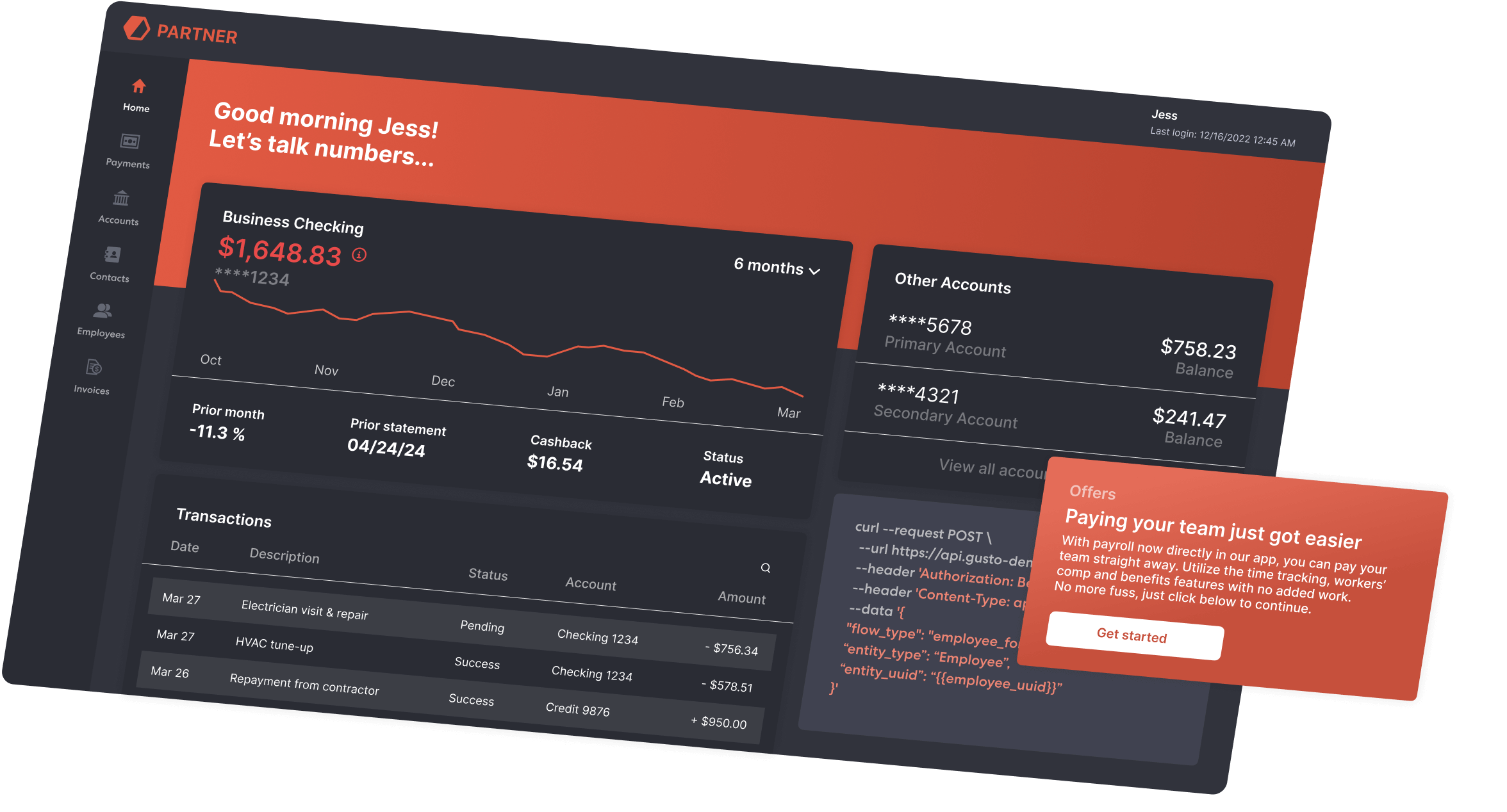

Embedded payroll for banking and fintech

Whether you provide payments, banking, lending, or complete financial services, your customers all need to manage payroll. Embedding payroll can help reduce complexity, consolidate applications, and take you one step closer to becoming a one-stop shop.

See how our finance partners use embedded payroll

- Increase revenue with a value-added service

- Reduce churn by offering business-critical payroll

- Become an all-in-one solution for mental health professionals

“Building payroll at national scale requires deep knowledge and understanding. With Gusto Embedded, we are able to decrease the time to offer a leading payroll service while increasing the value we’re able to deliver to our customers.”Jessica Young MD & Head of Product, Chase Payment Solutions

Embedded payroll for vertical SaaS platforms

With Gusto Embedded Payroll, you can build a tailored service your customers will love to use. The best part? They never have to leave your platform. By providing them all-in-one service, you’ll be driving their success as well as your own.

See how our vertical SaaS partners use embedded payroll

- Accelerate early adoption by migrating shared customers

- Minimize launch risks with a decade of payroll insights

- Secure long-term growth by partnering strategically with Gusto

- Increase revenue with a value-added service

- Reduce churn by offering business-critical payroll

- Become an all-in-one solution for mental health professionals

Ship quickly.

Our UI flows are ready when you are to customize and scale.

Reduce churn.

Providing payroll is a great way to keep your customers coming back.

Build smarter.

Because we’re established, we can provide usage data on customers in your vertical.

It takes years to learn the ins and outs of payroll. Instead, partner with the only provider that has worked for over a decade to build an infrastructure you can rely on.

01

Migrations managed

Switching payroll providers isn’t easy. Done poorly, it can lead to heavy penalties for customers. Gusto’s technology makes migrations a breeze for your customers, any time of year.

02

Industry-leading support

Gusto maintains a NPS >70 because we provide best-in-class support to match our payroll. Our friendly experts are available to you and your customers by phone, Slack, or email.

03

Reliability at scale

There are thousands of tax code changes each year, in 11,000+ jurisdictions across 50 states. Enjoy access to the same tax filing infrastructure and compliance teams that serve over 300,000 businesses.

Our payroll

is more

than a product

— it's a full service.

A payroll solution involves providing world-class support and service. That means you can’t just white-label a flimsy payroll app. With Gusto Embedded, you get 10 years of experience, industry-leading support, and robust reliability at scale.

Your customers are excited about what they do, but probably not about payroll. They want a product that’s as quick and easy to use as possible. We’ve spent over a decade optimizing our technology for complexity and scalability, so that you and your customers can focus on what’s important.

Sales enablement

Sell like you've been doing this for a decade. Our team works with sellers to answer payroll questions and help you target new customers.

True partnership

Gusto is committed to making our partners successful in payroll. From analyzing usage data to co-marketing with you, we go above and beyond.

Developer support

We offer complete developer documentation, guides, and real-time support to integrate payroll into your platform.

“Our focus has always been to build time-saving solutions for dental practices. Integrating payroll directly into Archy is not just an innovative move, it makes Archy the only practice management software that offers payroll directly within the software that practices use every day.”Jonathan Rat CEO, Archy

Embedded payroll for accounting and bookkeeping

Gusto Embedded makes it easier for firms of any size to offer competitive products and services. With all your customers’ financials stored on one easy-to-use platform, your customers enjoy a more seamless experience and fewer integration headaches.

Evolve efficiently and securely.

Offering payroll is the natural next step for a modern accounting firm.

Maintain one source of truth.

Provide a single pane of glass with all your relevant financial information.

Lead the way forward.

In an increasingly tech-enabled space, you’ll have a competitive edge.

With over a decade of experience running and supporting payroll for our own customers, only Gusto has the proven technology to handle the complexity and scale of your business.

01

Take care of your people.

Our infrastructure is optimized for calculating salaries, hourly wages, overtime, and more. Direct deposit employee paychecks, plus generate pay stubs and W-2s.

02

Stay ahead of the IRS.

Automatically file local, state, and federal payroll taxes. Gusto’s tax expertise spans all 50 states.

03

Call for backup.

Gusto trains your teams and automates many of your processes, but when you need live support, our experts are available via phone, Slack, or email.

Our payroll

is more

than a product

— it's a full service.

A payroll solution involves providing world-class support and service. That means you can’t just white-label a flimsy payroll app. With Gusto Embedded, you get 10 years of experience, industry-leading support, and robust reliability at scale.

Your customers are excited about what they do, but probably not about payroll. They want a product that’s as quick and easy to use as possible. We’ve spent over a decade optimizing our technology for complexity and scalability, so that you and your customers can focus on what’s important.

Collaboration

We work with your leadership, product, engineering, finance, and service teams to design the end-to-end experiences for your application.

Speed

We enable you to iterate and improve your payroll product as quickly as your team can move, so you can stay ahead of your market.

Commitment

Your success is our success. We are committed to designing and marketing a payroll solution that you’ll be proud of.

“Gusto Embedded Payroll enables us to deliver the first integrated all-in-one financial platform for businesses-of-one. We're excited to streamline our customer experience with the most trusted partner in the market.”Hooman Radfar CEO, Collective

Embedded payroll for HR tech and HRIS platforms

Help HR teams save even more time by embedding payroll alongside the team and performance management tools your HR technology platform already offers.

Serve as the system of record.

With payroll, everything HR is now in one place.

Grow with your customers.

Serve more of the employee lifecycle by offering payroll.

Build for the future.

Connect pay to employee performance and satisfaction.

Your customers will be able to manage, support, and pay their teams in one place.

Accurate and reliable payroll is complex. But when you partner with Gusto, your customers won’t sweat it – and neither will their employees.

01

Payroll that looks native, because it is.

Embedded payroll fits perfectly into your product suite, because it looks and works just like any other.

02

Room (and data) to grow.

Leverage the additional data you’ll get from embedding payroll to grow the rest of your business.

03

Help behind the scenes.

Your customers will think you’ve been building and selling payroll for over a decade, just like Gusto. But when a tricky question comes up, we’re always here to help.

Our payroll

is more

than a product

— it's a full service.

A payroll solution involves providing world-class support and service. That means you can’t just white-label a flimsy payroll app. With Gusto Embedded, you get 10 years of experience, industry-leading support, and robust reliability at scale.

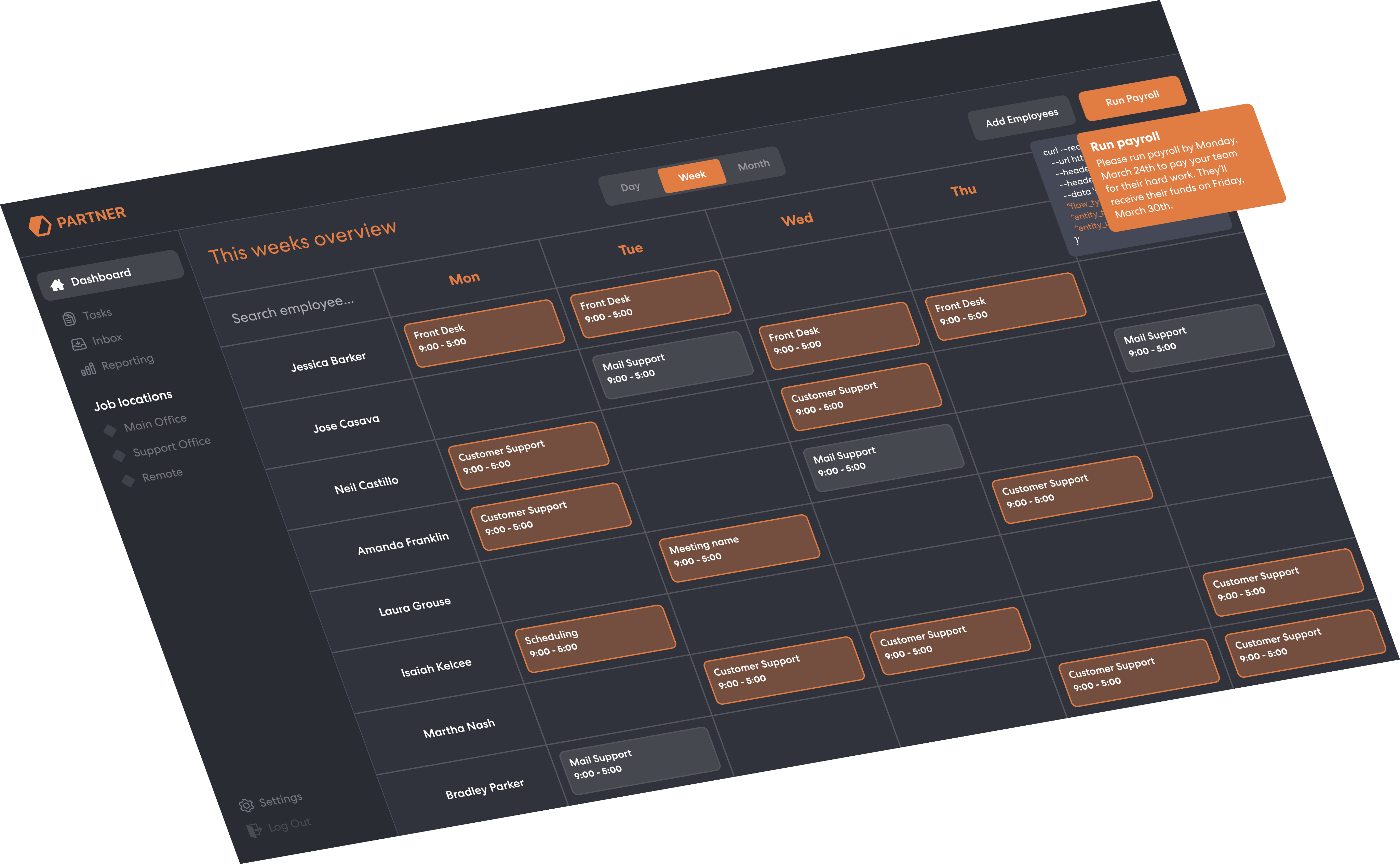

Embedded payroll for time and attendance

Make your platform an all-in-one solution by offering payroll alongside time tracking and scheduling for hourly employees.

Stand out from the crowd.

With a tailored payroll product, you’ll have an attractive new revenue engine that keeps customers on your platform.

Automation means reliability.

Our software tracks all the moving pieces, so your customers don’t miss important details when it’s time to cut paychecks.

Understand your customers.

Payroll data reveals a more complete picture of your customers’ business, on both a macro and micro level.

A payroll product isn’t something you dust off once a month. Keeping up with ever-changing compliance issues and financial information is as important as accurately tracking your team’s hours. That’s why it’s essential to partner with the best in the industry.

01

Run a tight ship.

You own the front-end payroll experience, while Gusto handles the back-end tax calculations and payments. Plus, Gusto's team and technology make migrations a breeze for your customers.

02

Stay ahead of it.

You and your customers get access to the same compliance teams and tax filing infrastructure that serve hundreds of thousands of businesses.

03

We’ve got your back.

Enjoy dedicated service and support working with hundreds of local, state, and federal tax agencies so your customers can pay their teams and file payroll taxes confidently.

Our payroll

is more

than a product

— it's a full service.

A payroll solution involves providing world-class support and service. That means you can’t just white-label a flimsy payroll app. With Gusto Embedded, you get 10 years of experience, industry-leading support, and robust reliability at scale.

With Gusto Embedded, you can customize and streamline your payroll product to integrate seamlessly with your existing time and attendance platform. Just like your customers are always elevating their business, we’ll work with you to continuously drive your success at every level of your organization.

Go-to-market enablement

Lean on messages and tactics with 10+ years of success behind them. Our team works with sellers to answer payroll questions and help you target new customers.

True partnership

Gusto is committed to making our partners successful in payroll. From analyzing usage data to co-marketing with you, we go above and beyond.

Developer support

Test and trial confidently with support from Gusto’s best-in-class devrel team. Plus, complete developer docs, guides, and more.

“Now, with Gusto Embedded Payroll, we can offer a tailored payroll experience that meets our high standards of quality, reliability, and customer service.”Derrik Shakespear Chief Revenue Officer, busybusy

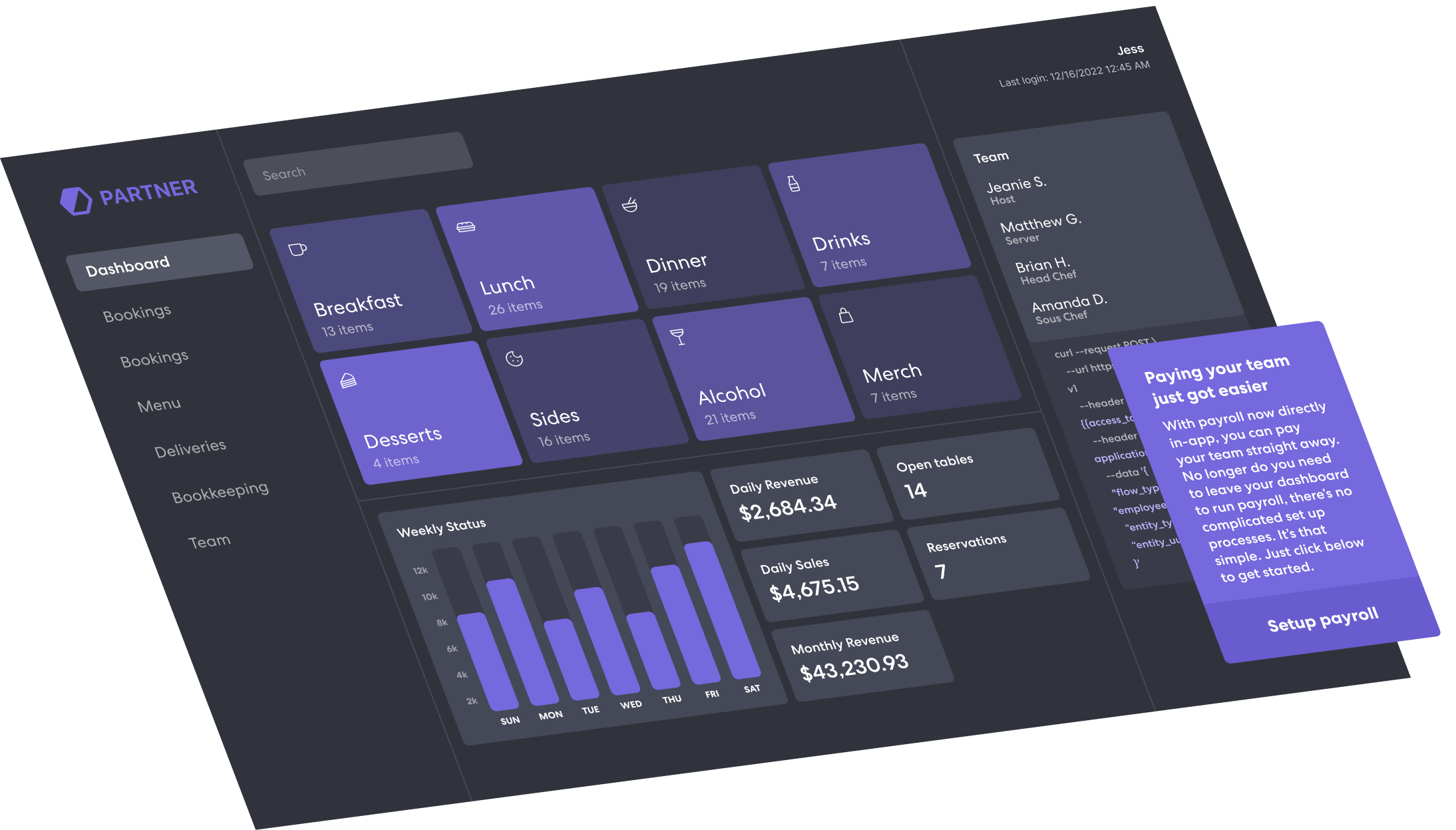

Embedded payroll for point-of-sale systems

POS systems already serve as the nerve center of many SMBs. Add the last piece of the puzzle with payroll. Everything your customers need to manage their business in one place.

Be the all-in-one.

From payments to time and attendance, POS systems increasingly serve as the SMB system of record.

Increase stickiness.

Providing value-added services like payroll sets your POS apart and solves more customer pain.

Serve your customers better.

With added data from embedded payroll, you can offer SMBs the right add-on products at the right time.

Payroll is more than just sending a check. Leverage Gusto’s 10+ years of experience selling and supporting payroll.

01

Build on the best.

Leverage Gusto’s expertise to a build payroll product your customers will love, and one that protects your business with industry-leading risk and fraud protections.

02

Help along the way.

We’re here to help during the planning, building, and launch phases. And after launch, we’re here to help with go-to-market and support, too.

03

Reliability at scale.

With over 15,000 tax code changes every year, you need a partner with experience. Rely on the same tax and compliance expertise trusted by 300,000+ businesses in the US.

Our payroll

is more

than a product

— it's a full service.

A payroll solution involves providing world-class support and service. That means you can’t just white-label a flimsy payroll app. With Gusto Embedded, you get 10 years of experience, industry-leading support, and robust reliability at scale.